Why accounts of 50 firms operating loan apps are frozen –FCCPC boss

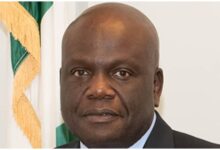

Babatunde Irukera is the Executive Vice-Chairman/Chief Executive Officer of the Federal Competition and Consumer Protection Commission, formerly known as the Consumer Protection Council. A lawyer by training, Irukera became the FCCPC helmsman in 2019 when the Federal Competition and Consumer Protection Act was enacted. In this interview with Odinaka Anudu, he disclosed that the agency had taken strong actions against loan apps and other firms violating the rights of Nigerian consumers.

Some Nigerians would say that you are late to the party regarding your recent intervention in the activities of digital loan firms which harass and threaten Nigerians who took loans from them. In one of your public comments, you promised to take them to court. Have you taken anyone of them to court?

In reality, we are not late to the party. The robustness of your action is what determines whether or not you are late to the party. This is happening across the continent. We are the leading regulator on the continent; others are looking to learn from us on how we are succeeding. It is not likely you are late to the party when others in the party are asking you the dance steps.

We have so far frozen 50 accounts. We have taken over 12 applications off the Google Play Store and we are in discussions with more than 10 companies right now. The rate of defamatory messages has dropped by at least 60 per cent. I am not saying they have stopped but they have dropped by at least 60 per cent. More than half of the companies that are currently before us have agreed that they will have to modify their behaviour. Many of them have changed some of their systems, including sacking some employees who sent defamatory messages. We are developing a regulatory framework that will involve other regulators, and we are prosecuting at least one company right now.

Just one company?

Well, money lending itself is not a criminal conduct. So, you have to determine there has been a crime. And even defamation, when civil, is not something a regulator can enforce. It is an injury to reputation that is only enforceable by the injured party and through the judicial process. What we are doing as a regulator includes things that the law gives us power to do. Some of these things are still happening, but we will continue the work to eradicate them.

How do you determine companies to prosecute?

It is from investigations. It is basically from what we get from our investigations.

How many companies are you investigating at the moment?

I just told you that at least 10 companies are engaged with us in one way or the other. They are even more than 10 at the moment.

Some people tend to think that certain individuals and companies are dominant in the Nigerian economy. How do you ensure that one company does not fraudulently push away a competitor in the same industry?

We have at least three major investigations opened into companies which we think are abusing their market dominance in a manner that will frustrate smaller players. When we look at the market and consider it inefficient, whether it is a monopoly or market dominance, the first thing we do is to unlock the barriers for others to enter. It is when you do that that you see the market correct itself. It needs the regulator to address certain behaviour in the market. Don’t forget that the competition law was introduced in Nigeria only in 2019. We lost the whole of 2020 to COVID-19. So, the amount of market intervention that the FCCPC has succeeded in doing is actually commendable and commended widely. One of the ways that you may not know that we have addressed monopolies is in the area of mergers and acquisitions. We are refusing to approve mergers which we think will lead to dominance and possible monopolies and disruption to the market.

Can you give examples?

For instance, the big mergers that occurred in key food industries recently, we had to put some conditions in place.